Competing Against Bigger Companies: Lessons from Taobao’s Strategy to Beat eBay in China

In business, large companies often seem unbeatable thanks to the power of network effects and economies of scale. However, history has shown that smaller, nimble competitors can sometimes gain an edge through creative strategies. One case in point is China’s Taobao, which managed to displace eBay’s dominant position despite its vast size and resources.

Taobao’s victory over eBay holds important lessons for other underdog companies on competing through differentiation and strategic agility. This article will analyze Taobao’s approach using the “Value Stick” framework for visualizing how companies capture value from customers and suppliers. While no single strategy guarantees success, understanding where you can claim value is key to challenging larger rivals.

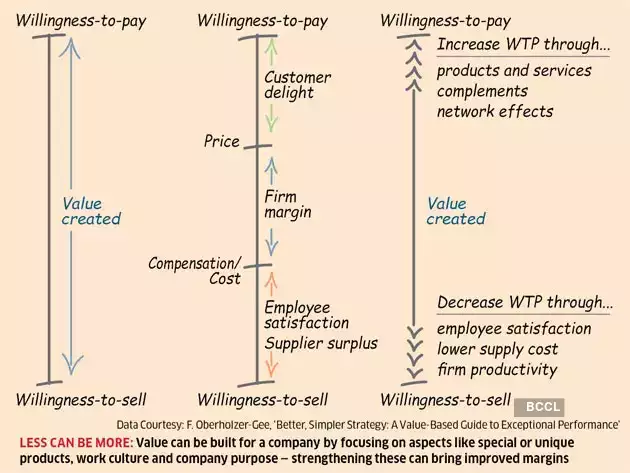

The Value Stick Framework

Popularized by Harvard Business School professor Felix Oberholzer-Gee, the Value Stick is a simple visual tool for mapping out how a company can maximize value from a transaction. It consists of four key elements:

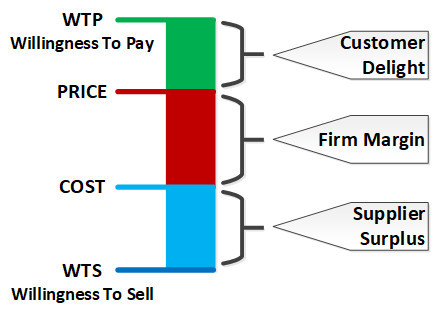

Willingness to Pay (WTP): The maximum price a customer will pay for a product or service based on its perceived value. This forms the upper limit of what a company can charge.

Price: The actual amount a company charges for its product or service. This is the portion of value captured by the company.

Cost: The company’s expenditures to produce and market the product or service. This represents the base value captured by suppliers.

Willingness to Accept (WTA): The minimum price suppliers will accept to provide necessary goods and services to the company. This forms the lower limit of costs.

On the Value Stick, Willingness to Pay sits at the top, Willingness to Accept at the bottom, and Price and Cost are placed in between based on the company’s pricing strategy. The spaces between each element represent the value captured by different parties:

Customer Surplus = Willingness to Pay – Price

Company Margin = Price – Cost

Supplier Surplus = Cost – Willingness to Accept

By analyzing these dynamics, companies can find ways to increase their margin by:

Raising prices closer to customers’ Willingness to Pay

Lowering costs closer to suppliers’ Willingness to Accept

Increasing Willingness to Pay through added value

Decreasing Willingness to Accept through supplier negotiation

Understanding where you can claim value is key to challenging larger rivals with advantages of scale and network effects. This leads us to the story of Taobao versus eBay.

The eBay-Taobao Battleground

In the early 2000s, eBay dominated the online auction space globally. After winning markets across North America and Europe, it sought to capture the emerging opportunity in China.

eBay’s China entry began strongly. It acquired EachNet, a local player started by Harvard Business School graduates, and quickly captured over 80% market share by 2003. Buoyed by success abroad and its leading position in China, eBay was confident it would prevail in the market.

However, within just 4 years, a homegrown company named Taobao displaced eBay to become China’s leading consumer e-commerce site. By the time eBay admitted defeat and exited China in 2006, Taobao claimed over 75% market share.

What enabled Taobao, a small startup, to defeat the global giant eBay on its own turf? The answer lies in how it utilized differentiation and strategic agility to reshape the Value Stick in its favor.

Taobao’s Differentiation Strategy

Taobao understood that as the market leader, eBay enjoyed substantial Customer Surplus due to network effects. Its large buyer and seller base made it more valuable to each new user, allowing eBay to charge high fees without denting demand.

To shift value capture in its favor, Taobao employed three key strategic moves:

1) Competing for “Near Customers” instead of eBay users:

Taobao noticed there were many potential shoppers still hesitant to buy online due to lack of trust in sellers and concerns over fraud. These “Near Customers” represented an untapped market eBay had not focused on.

By tailoring its platform to address Near Customers’ concerns, Taobao increased their Willingness to Pay for e-commerce without having to poach eBay’s core user base. Features like seller ratings and escrow payments via Alipay helped build trust in the market.

2) Using a Freemium model:

Taobao offered free listings for sellers, undercutting the fees eBay charged. This lowered Costs for sellers, increasing Taobao’s competitiveness.

For buyers, Taobao concentrated on building its user base and liquidity before monetizing. This followed the freemium model of setting a zero Price to attract users. Once network effects kicked in, Taobao could start extracting value.

3) Developing unique complementary services:

As highlighted earlier, companies can boost Willingness to Pay by offering “complements” that make the core product more valuable. Taobao invested heavily in complements like Alipay that increased user trust and convenience.

Not only did these complements help Taobao poach Near Customers, but they also generated valuable user data to fuel targeted product development and advertising. Complements thus created a self-reinforcing ecosystem around Taobao’s marketplace.

Through this three-pronged strategy, Taobao reshaped its Value Stick to claim more Margin than eBay. First, it expanded the overall pie of value created by tapping into Near Customers. Next, it reduced costs by undercutting eBay’s fees. Finally, complements like Alipay further increased user willingness to pay.

Taobao’s Strategic Agility

Beyond smart differentiation, Taobao also beat eBay through sheer strategic agility. Its smaller size allowed it to iterate products and pivot strategies rapidly based on user data. Taobao moved quickly from B2B to B2C and marketplace to social commerce to outflank eBay.

In contrast, the rigidities of eBay’s global organization slowed adaptation to local needs. It was optimized for Western-style auction models, not realizing China’s preference for fixed-price retail. eBay also prioritized PayPal rather than building local payment solutions suited to Chinese consumer habits.

Taobao’s agility let it take advantage of brief windows of opportunity to pull ahead before eBay could react. Once it built sufficient scale, network effects momentum drove eBay out of the market. Speed and flexibility thus amplified the advantages Taobao created through differentiation.

Key Takeaways

The lessons from Taobao’s success apply broadly beyond e-commerce to any scenario where a small player challenges an industry leader:

- Leverage strategic agility: your ability to move fast gives you an edge against slower-moving giants bogged down by bureaucracy.

- Differentiate by reshaping the Value Stick: target untapped markets, undercut on cost, or boost value through complements.

- Pick strategies with low marginal costs: avoid high fixed costs that play to the strengths of giants with economies of scale.

- Follow the data: instrument everything and objectively analyze user behavior to quickly adapt offerings and head off competition.

- Play the long game: have patience to execute a sustainable strategy rather than seek quick gains. Victory often goes to the persistent.

- While a thoughtful strategy is critical, ultimately success depends on skillful execution. Taobao excelled on both fronts, allowing it to successfully unlock value that eBay had overlooked. The company’s journey highlights how even Goliaths can be felled by a few well-placed stones.